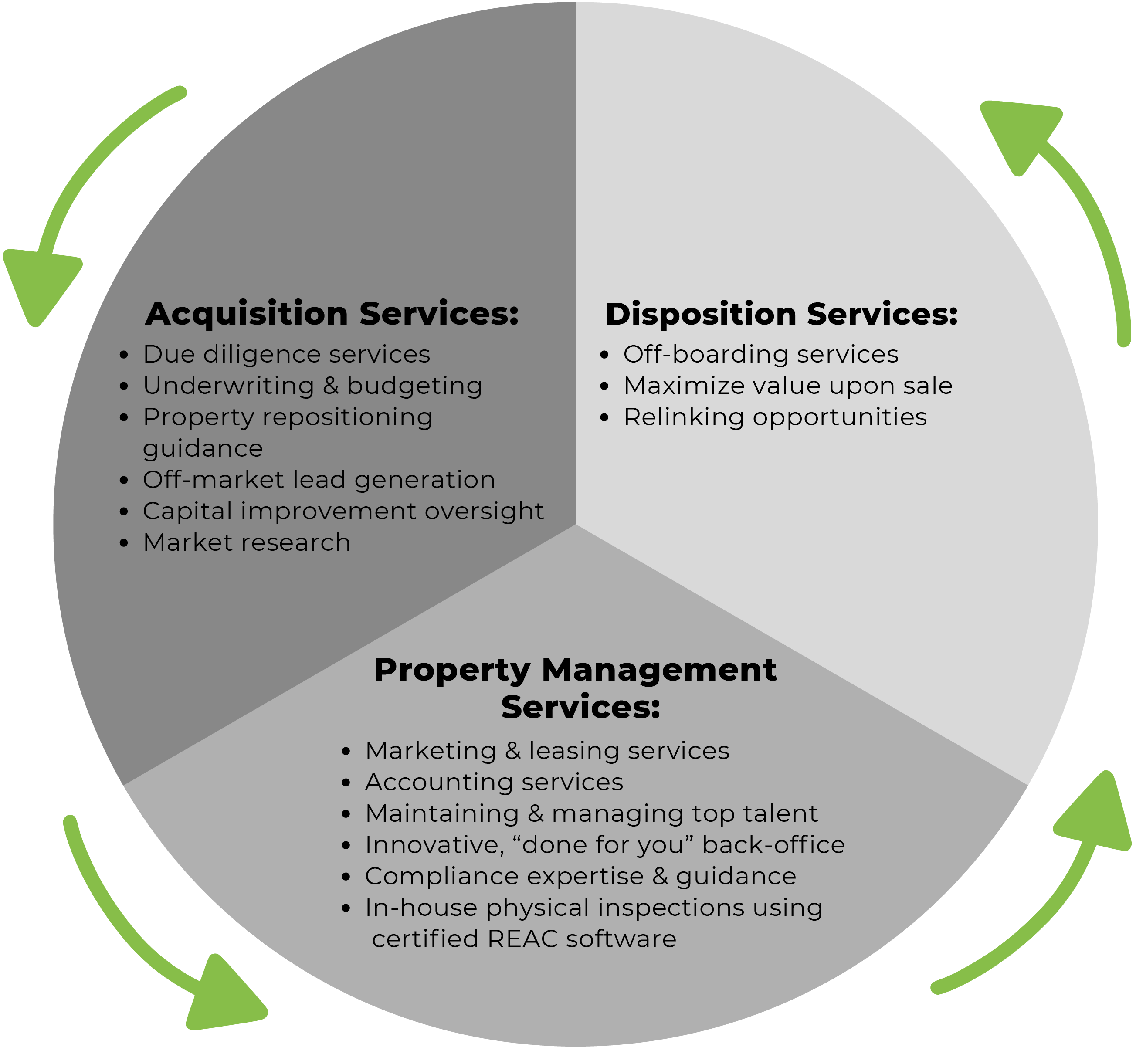

Full suite of services

Advanced Services

rapid lease-ups & stabilization post-lease-ups

ratio utility billing system (rubs) program

hoa management services

financial controls and reporting

in-house compliance expertise & guidance

valet trash systems

onsite resident services

private access to concierge services

tenant services with high satisfaction

management of luxury communities

risk mitigation

extensive personnel training